Get informed with this definitive guide to Medicare audits so that you can understand the process. Remember, audits can be costly and should only be handled by a knowledgeable healthcare compliance professional. Safe Harbor Group’s healthcare compliance specialists have worked for the federal government, most major health insurance companies, and state medical boards. Click below to contact us if we can assist you or just answer a question.

Facing an Audit? Don’t Go at It Alone.

We Saved Our Client $550 Million Last Year.

Understanding Medicare Administrative Contractor (MAC) Audits

Medicare Administrative Contractors (MACs) play an important role in managing the Medicare program. But facing a Medicare audit can be stressful for providers and can result in significant overpayment demands, civil investigations, and even criminal allegations of healthcare fraud. By choosing the right Medicare Audit defense firm, you can reduce the burden and eliminate the risk of overpayment demands and penalties.

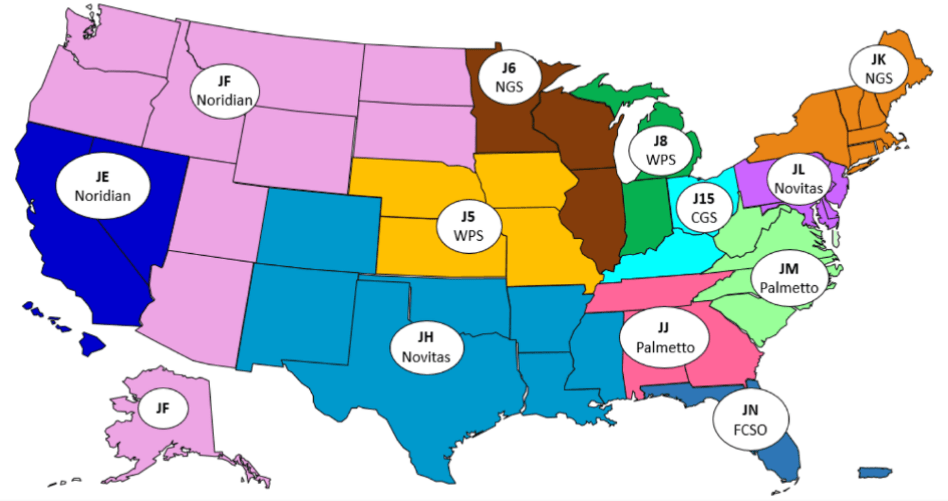

Before delving into the specifics of Medicare audits, it is important to understand the entities that may audit your practice. The most common form of audit is a MAC audit. Multiple MACs cover different geographic regions across the United States.

Medicare Audit Defense: What is a MAC?

MACs are private companies contracted by the Centers for Medicare and Medicaid Services (CMS) to perform a variety of administrative tasks related to the Medicare program. MACs perform a variety of tasks related to the processing of Medicare claims, including verifying eligibility, reviewing claims for accuracy and completeness, and paying claims to healthcare providers. They also conduct pre-payment and post-payment reviews to ensure that Medicare is paying for appropriate services and that providers are complying with Medicare regulations.

What is a MAC Audit?

One of the key functions of MACs is to perform audits of healthcare providers to ensure compliance with Medicare regulations. These audits can be conducted on a pre-payment or post-payment basis, and they can be initiated for a variety of reasons, including:

Routine Reviews

MACs are required to conduct routine reviews of healthcare providers to ensure compliance with Medicare regulations.

Provider Specific Reviews

MACs may initiate audits of individual healthcare providers if there are concerns about their billing practices or if they have been identified as having a high error rate.

Targeted Reviews

MACs may also conduct targeted reviews of specific services or procedures if there are concerns about overutilization or improper billing.

MAC audits can take several forms, including desk audits, medical record reviews, and site visits. Desk audits involve reviewing documentation submitted by the provider. In contrast, medical record reviews include examining the patient’s medical record to ensure that the services provided were medically necessary and appropriately documented. Site visits involve an in-person review of the provider’s facilities and operations.

What Are Providers Required to Do to Comply with a MAC Audit?

When a provider is notified of a MAC audit, they will typically be asked to submit documentation to support the services billed to Medicare. This documentation may include:

Medical Records

Providers will typically be asked to submit medical records for the patients in question. These records should document the services provided and support their medical necessity.

Billing Records

Providers may also be asked to submit billing records, including claims forms and explanation of benefits (EOB) statements.

Other Documentation

Depending on the nature of the audit, providers may be asked to submit other documentation, such as policies and procedures or contracts with other providers.

Providers should be prepared to respond promptly to audit requests and to provide complete and accurate documentation to support the services billed to Medicare. It is also important for providers to maintain accurate and complete documentation on an ongoing basis to ensure that they are prepared for any potential audits.

How Can SHG Assist a Healthcare Provider Facing a MAC Audit?

Facing a MAC audit can be stressful for healthcare providers, but there are resources available to assist them. Safe Harbor Group specializes in helping healthcare providers with compliance-related issues, including MAC audits.

SHG has a team of former insurance company special investigations unit (SIU) experts with extensive experience conducting audits and investigations. They can assist healthcare providers by:

- Conducting internal audits: SHG can audit healthcare providers to identify potential compliance issues and help them prepare for MAC audits.

- Responding to audit requests: SHG can assist healthcare providers in responding to MAC audit requests by ensuring that they provide complete and accurate documentation to support the services billed to Medicare.

- Reviewing audit findings: If a healthcare provider receives an adverse audit finding, SHG can review the findings and guide the response.

- Developing corrective action plans: If a healthcare provider is found to have compliance issues, SHG can assist them in developing corrective action plans to address those issues and prevent future compliance problems.

SHG’s team of former SIU experts has extensive experience conducting audits and investigations, as well as a deep understanding of Medicare regulations and compliance requirements. They can provide valuable guidance and support to healthcare providers facing MAC audits, helping them to navigate the audit process and achieve a positive outcome.

Facing an Audit? Don’t Go at It Alone.

We Saved Our Client $550 Million Last Year.

MAC Audit Process Outline

Initial risk assessment

- Review claims data

- Analyze provider billing patterns

- Identify potential areas of concern

Pre-audit notification

- Send a notice to the provider about the upcoming audit

- Request necessary documentation and records

Documentation submission

- Outline how records should be organized and delivered.

- Provide deadlines and acceptable formats for submission.

Provider gathers the requested documentation

- Collect charts, invoices, and supporting clinical notes.

- Verify that each record aligns with the specific claims in question.

Provider submits documentation to the MAC

- Send all materials through the designated secure channel.

- Confirm receipt to avoid delays.

Documentation review

- Compare submitted records against Medicare billing rules.

- Check for missing details, coding issues, or insufficient justification.

On-site visit (if necessary)

- Auditors may tour the facility and review additional records.

- Staff interviews may be conducted to clarify processes or workflows.

Post-audit findings

- MAC prepares preliminary results based on reviewed data.

- Providers may receive requests for clarification or more records.

Audit report

- Summarizes compliance issues, overpayments, or documentation gaps.

- Includes evidence and explanations backing each finding.

Provider response

- Opportunity to refute findings with additional information.

- Providers may request a discussion or submit written explanations.

Final determination

- MAC issues its conclusive decision after reviewing any responses.

- The determination outlines required payments or next steps.

Repayment or appeal

- Providers repay identified overpayments within the given window.

- If disputing the result, the formal appeal process can be initiated.

Corrective action plan (if necessary)

- Provider may implement policy updates or staff training.

- Plans often include ongoing internal monitoring to prevent future issues.

Follow-up audits (if necessary)

- MAC reviews progress on previously identified issues.

- Additional record checks may occur to confirm compliance.

Why Choose Safe Harbor Group for Help With MAC Audits in Detroit

MAC audits are an important tool for ensuring compliance with Medicare regulations and preventing fraud and abuse. Healthcare providers should be prepared to respond promptly and thoroughly to audit requests and maintain accurate, complete documentation to support the services they bill to Medicare.

SHG can provide valuable assistance to healthcare providers facing MAC audits, helping them to prepare for audits, respond to audit requests, and address any compliance issues that may arise. With the help of SHG’s expert team, healthcare providers can navigate the audit process with confidence and achieve a positive outcome.

Don’t Navigate a MAC Audit Alone

A MAC audit can place real pressure on your organization, but the right support can make the process far more manageable. Safe Harbor Group draws on insights from former SIU professionals and seasoned compliance specialists who understand how these reviews unfold and what regulators expect. If you need help preparing documentation, responding to audit findings, or strengthening internal processes, reach out for guidance you can rely on.